| |

Robert G. Alexander Webinar Series

The Robert G. Alexander Webinar Series

was created in September 2013 to provide estate planners with accessible, high

quality, multi-disciplinary education. Programs are available live and on-demand

and attendees can choose to register for individual programs, or for a series

subscription. We hope you will join us for an

upcoming program:

Wednesday, August 9, 2017, 3:00pm - 4:00pm ET

Alternatives to Self-settled Trusts • Gideon Rothschild, JD, CPA, AEP®

(Distinguished)

REGISTER HERE

Wednesday, September 13, 2017, 3:00pm - 4:00pm ET

The Perfect Modern Trust Including Income Tax Sheltering Opportunities •

Richard A. Oshins, JD, LL.M., MBA, AEP® (Distinguished)

REGISTER HERE

|

Continuing education credit is available at each webinar for Accredited Estate

Planner® designees. In addition, a general certificate of completion will be

made available for those professionals who feel the program satisfies their

continuing education requirements and are able to self-file. |

Individual program registration fees:

- $40 for active AEP® designees

- $60 for council members

- $100 for non-members

- $250 for a group gathering: one feed to be shown to a group gathered together in a single location,

additional feeds are available for $25

Series

Subscriptions are also available! The yearly subscription offers a

substantial discount to attend all of the programs during the calendar year!

(On-demand access is provided for all prior 2017 programs.)

Register for the series. Series

Subscriptions are also available! The yearly subscription offers a

substantial discount to attend all of the programs during the calendar year!

(On-demand access is provided for all prior 2017 programs.)

Register for the series.

- $280 Accredited Estate Planner® designee

($360 value)

- $420 Member of an affiliated local estate planning council or at-large

member of NAEPC ($540 value)

- $700 Non-member

($900 value)

-

$1,125 Council meeting / group gathering: one feed to be shown in a single

location to a group ($2,250 value)

|

|

The Annual NAEPC Estate Planning Strategies Conference has become the "go-to"

event for estate planners from across the country! An exciting line-up of

nationally-recognized speakers, coupled with a fabulous city, plush host hotel,

and incredibly competitive registration fees, make the 54th Annual Conference an

event that is not to be missed. You've already made NAEPC and your affiliated

local council your associations of choice; why not make the Annual NAEPC Estate

Planning Strategies Conference your continuing education and networking event of

choice? |

Abbreviated Conference Schedule

Wednesday, November 15, 2017

- Special Add-on Opportunity for Educational Attendees: Communication Across

Generations and the Impact of Family Philanthropy with Sharna Goldseker

Thursday, November 16, 2017 Educational Sessions

- 7:00 am Bonus Session: Life Insurance in Estate Planning: Beyond the Role of

Benefits for Beneficiaries & Tax Strategies

Darwin M. Bayston, CFA

Session provided by Berkshire Settlements, Inc.

- Modern Uses of Partnerships in Estate Planning

Paul S. Lee, JD, LL.M. (taxation), AEP® (Distinguished)

- Life Insurance Product Selection, Design and Funding: Making Fundamental

Decisions in Common Financial and Estate Planning Scenarios

Charles L. Ratner, JD, CLU®, ChFC®, AEP® (Distinguished)

- Sponsored General Session: Advanced Planning Applications for Market-Based Life

Insurance Valuations

William Clark, Jamie Mendelsohn & Jon B. Mendelsohn

Session provided by Ashar Group / Ashar SMV

- How Slippage and Gray Areas Lead Us Into Ethical Lapses

Marianne M. Jennings, JD

- Minimizing Family Conflicts in Estate Planning

John J. Scroggin, JD, LL.M., (taxation), AEP® (Distinguished) Nominee

- Current Issues in Estate and Gift Tax Audits and Litigation

John W. Porter, B.B.A., JD, AEP® (Distinguished)

Special Concurrent Sessions on

Thursday, November 16, 2017, 5:15 pm

- Annual Private Event for Active Accredited Estate Planner® Designees

and Estate Planning Law Specialist Certificants: Legacy Planning Reimagined:

a Discussion with Philip B. Cubeta, CLU®, ChFC®, MSFS, CAP®, AEP®

- The Accredited Estate Planner® Designation Program from A - Z

For those who are interested in learning more about or attaining the AEP®

designation, this session will provide an overview of the program and offer an

opportunity to have your questions answered by the experts at NAEPC.

Friday, November 17, 2017 Educational Sessions

- Tax-Efficient Drawdown Strategies during Retirement

Robert S. Keebler, CPA/PFS, MST, AEP® (Distinguished), CGMA

- Estate Planning Current Developments and Hot Topics

Steve R. Akers, JD, AEP® (Distinguished)

- Sponsored General Session: Understanding Asset Protection in the 21st Century

Douglass S. Lodmell, JD, LL.M.

Session provided by Asset Protection Council® / Lodmell & Lodmell, P.C.

- Inter Vivos Non-Grantor Trusts (Some Complete; Some Not) for State (and

Some Federal) Income Tax Minimization

William D. Lipkind, JD, LL.M.

- Planning for Privacy in a Public World: The Ethics and Mechanics of Protecting

your Client's Privacy and Personal Security

John Bergner, JD & Jeff Chadwick, JD

- Income Taxation of Trusts & Estates – Ten Things Estate Planners Need to Know

Mickey R. Davis, JD & Melissa J. Willms, JD, LL.M.

.png) |

|

To learn more about the conference, including

registration fees and packages, and to

download the

early bird brochure, please visit our

website. |

Sponsorships are still available! Those that have an interest can review the

conference sponsor kit or contact Ed Socorro at

ESocorro@NAEPCmarketing.org or

312-600-5303 for more details. We are grateful for the support of all conference

sponsors, including:

Please click on each logo to learn more.

Member Benefits

N ew member benefits this year include:

M

Brands Film M

Brands Film

Do you have website video? If not, you are turning away 90% of your prospects

and clients. Through a value partner arrangement with NAEPC,

M is offering video production services at a

20% discount to members.

Read more >

New council benefits this year include:

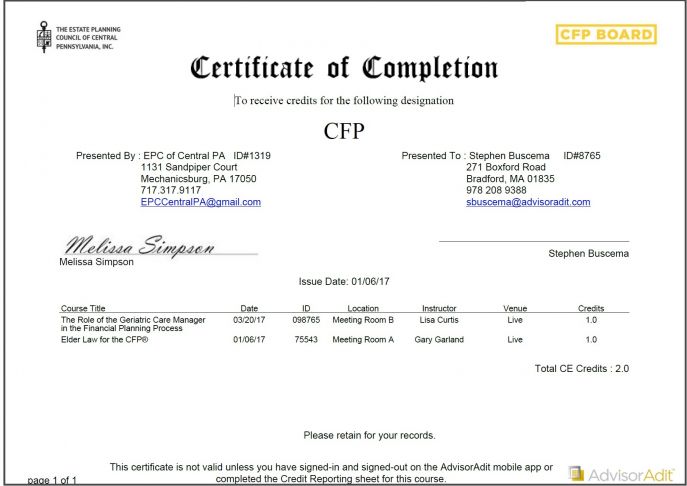

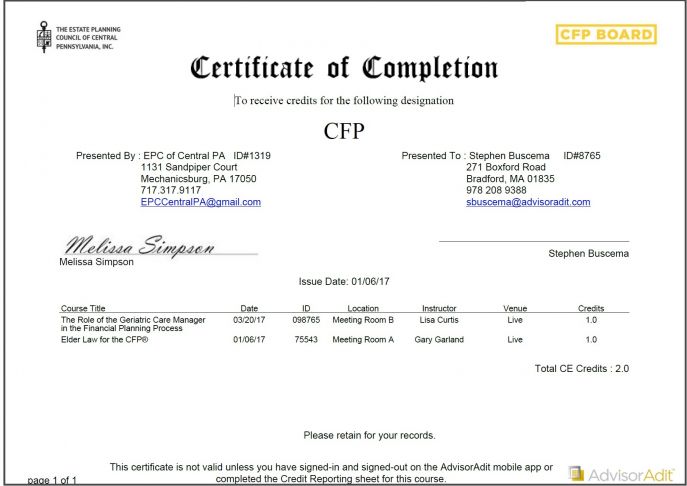

AdvisorAdit

- Mobile Event Services for Councils AdvisorAdit

- Mobile Event Services for Councils

DIGITAL CONFERENCE BOOK - COURSE SURVEYS - ATTENDANCE TRACKING

Introducing New NAEPC Program: 50% off standard rates and a free trial!

Our suite of mobile event services is a cost-effective way to modernize your

attendee experience.

Read more >

View all of the exciting benefits

available to you as a member of NAEPC, including our flagship benefit, a $149

subscription to

Trusts & Estates magazine (a 60% discount!).

We want to hear from you! What benefits would you like to see?

Email us

your suggestions today!

Accredited Estate Planner® Designation Program

The Accredited Estate Planner® (AEP®) designation truly embodies the

core value of NAEPC, excellence in estate planning. Three compelling reasons to

obtain the designation today:

|

|

Gain the competitive edge – set yourself apart from the competition Demonstrate that you have special knowledge, skill, and expertise in

multi-disciplinary estate planning

Give colleagues and consumers a way to identify you as a qualified

professional who stands ready to meet their needs

|

Abbreviated Program Requirements

- Core Mission – acknowledge an ongoing commitment to the team concept of estate

planning

- Credential – active license or certification as an attorney (JD), accountant

(CPA), insurance professional and financial planner (CLU®, ChFC®, CFP®, CFA,

CPWA®), philanthropy (CAP®, CSPG), or trust officer (CTFA)

- Experience – minimum of 5 years of experience in estate planning

- Reputation & Character – 3 professional references; one of whom must share the

applicant's primary discipline and 2 others from 2 different disciplines

- Education – applicants must successfully complete 2 graduate courses from The

American College or similar graduate courses through an accredited university,

college or school of law as part of a masters' or doctoral degree program (a

minimum of 15 years of experience in estate planning exempts one from this

requirement)

- Ethics – sign a declaration statement to continuously abide by the NAEPC Code of

Ethics

- Membership – maintain a membership within an affiliated local estate planning

council where one is geographically available (you've likely already met this

requirement!)

- Continuing Education – minimum of 30 hours of continuing education, 15 of which

must be in estate planning, every 24 months

Interested in learning more? Visit www.NAEPC.org/AEP or contact our national

office at (866) 226-2224 or admin@naepc.org.

Message from the

President

Paul S. Viren, CLU®, ChFC®, AEP®

Viren & Associates, Inc.

Spokane, WA

Summer is upon us! I wish you and your family a healthy and happy season! At NAEPC, we are in the midst of a summer "makeover" of our newsletter

and website, among other exciting activities. Keep an eye out, you will see a

brand new look and feel coming soon to your association of choice!

As I keyed my thoughts for this newsletter, fresh from our first of two

annual face-to-face national board meetings not very long ago, I thought I would

share a few "Did you know?" facts about NAEPC. Our top ten list, if you will!

- Fact #1: As a member of an affiliated local council, you are granted

membership rights at NAEPC and can take advantage of all of the benefits and

services offered by the national organization.

- Fact #2: Our mission is simple - Excellence in Estate Planning

- Fact #3: This newsletter is your link to the "happenings" at NAEPC – make sure to keep an eye out for future issues.

- Fact #4: NAEPC boasts over 270 affiliated estate planning councils,

including their estimated 30,000 individual members.

- Fact #5: NAEPC has over 70 dedicated volunteer board and committee

members working hard to provide value to you, our member.

- Fact #6: The Accredited Estate Planner® designation

is the only graduate level, multi-disciplinary designation in estate

planning.

- Fact #7: At any given time, NAEPC offers approximately 40

discounted benefits to our members.

- Fact #8: The Annual NAEPC Advanced Estate Planning

Strategies Conference is available to the entire estate planning

community and provides two full days of national, multi-disciplinary

continuing education credit.

- Fact #9: The Robert G. Alexander Webinar Series

provides monthly educational events with the brightest minds in estate

planning tackling touch technical topics in an understandable way. You can

take advantage of the member rate to attend!

- Fact #10: You can

opt in to receiving more frequent communications from

NAEPC in less than a minute.

I hope that you learned something new about NAEPC after reading the bullets

above! I do hope for an opportunity to meet you in person this November 15-17 in

New Orleans!

Until November,

|

|

|

|

|

![]()

![]()

Series

Subscriptions are also available! The yearly subscription offers a

substantial discount to attend all of the programs during the calendar year!

(On-demand access is provided for all prior 2017 programs.)

Series

Subscriptions are also available! The yearly subscription offers a

substantial discount to attend all of the programs during the calendar year!

(On-demand access is provided for all prior 2017 programs.)

.png)